Product prices are considered numerical gold by researchers and budding entrepreneurs. Typically proprietary, this data often comes at a high cost, an irony not lost on those who seek it. Fortunately, Lippincott Library provides access to several databases that contain product prices:

Mintel Global New Products Database (GNPD)

The Mintel Global New Products Database (GNPD) is a resource for researching the consumer packaged goods (CPG) marketplace. GNPD focuses on new products in the food, drink, beauty and personal care, home care, health and hygiene, and pet markets in 86 countries. In addition to new products, GNPD includes relaunched, reformulated, and repackaged products and new varieties or extended ranges of existing products.

To access GNPD from the Mintel platform, navigate to the Analytics menu at the top of the page and scroll over Products. From there, perform a basic keyword search or access the Advanced Search tool.

Product records provide Company & Source Details including manufacturer/distributor and name of retail store where the product was purchased, as well as Product Details including product description and positioning claims, package size, and product price at purchase location:

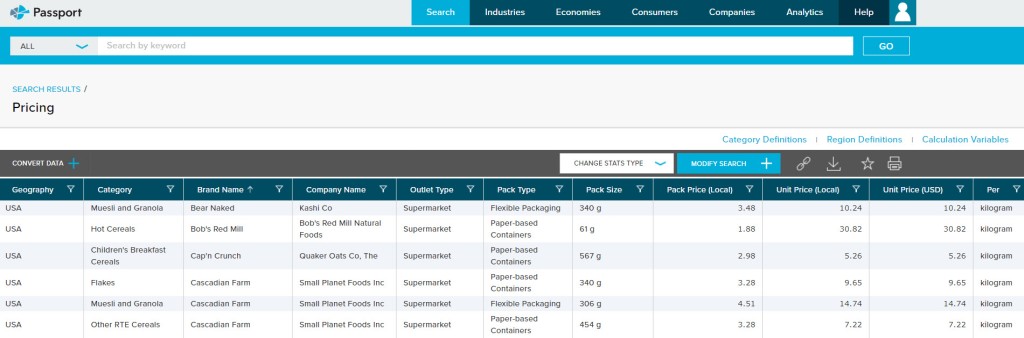

This market information database covers consumer products and services on a global level. Prices are available for some products, such as Breakfast Cereals in USA:

Statista repackages third-party statistics from both publicly available and commercial sources, covering a variety of industries throughout the world. To locate available price statistics for a particular product, search for the product keyword followed by the word price (e.g. juice price). On the search results page, use the left side menu to filter results as desired, such as by geography.

For example, a keyword search for juice price with Countries & Territories limited to United States includes the following Beverage Digest chart depicting retail prices of juices and juice drinks in the United States from 2012 to 2019 in U.S. dollars per case:

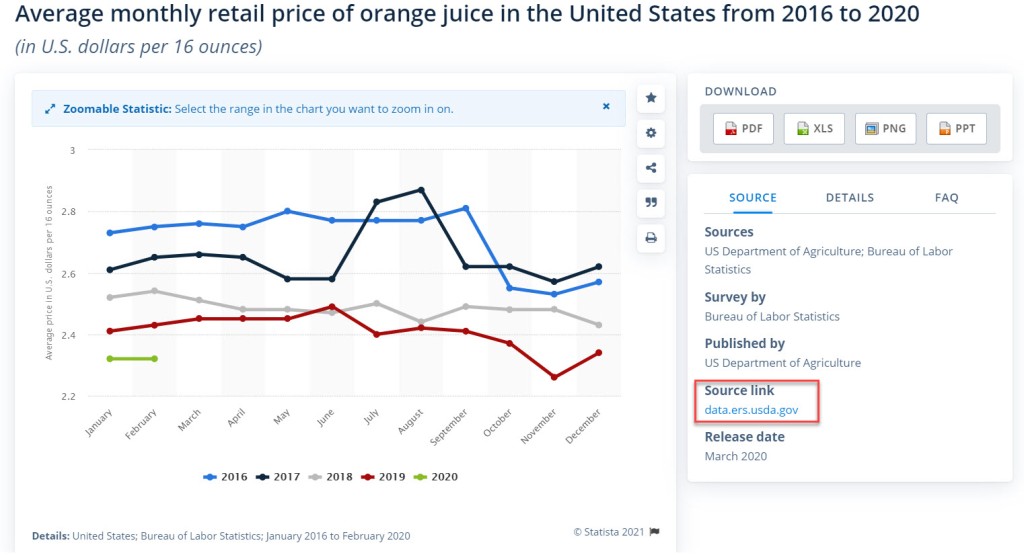

Statista’s charts and graphs include source information, making it easy to locate additional or updated price statistics from publicly available sources. For example, on the following chart depicting the average monthly retail price of orange juice in the United States from 2016 to 2020, the Sources field indicates that the U.S. Department of Agriculture is a source of this data, and the Source link is provided.

Clicking the source URL directs to a page on the USDA website featuring U.S. monthly average retail prices for fresh and processed fruits, including orange juice:

Designed to help purchasing and procurement managers make informed purchasing decisions, ProcurementIQ contains reports covering more than 1,000 indirect products and services in the United States. While reports target a commercial or industrial audience, some include residential focus. Search for a product by name (e.g. smoke detectors) to retrieve a report that includes a Price Environment section featuring a price summary, fundamentals, drivers, trends, forecasts, and more:

GlobalData Medical focuses on the medical device, equipment, and supply industries throughout the world.

From the main menu, select Tools, then in the Medtrics Analysis Tool section, select the desired medical device product to access historical and forecasted Average Selling Prices for specific categories of medical device products across market segments and geographic areas. For example, this chart depicts Average Selling Prices for Laparoscopes in the General Surgery market across multiple countries from 2020 forecasted through 2023:

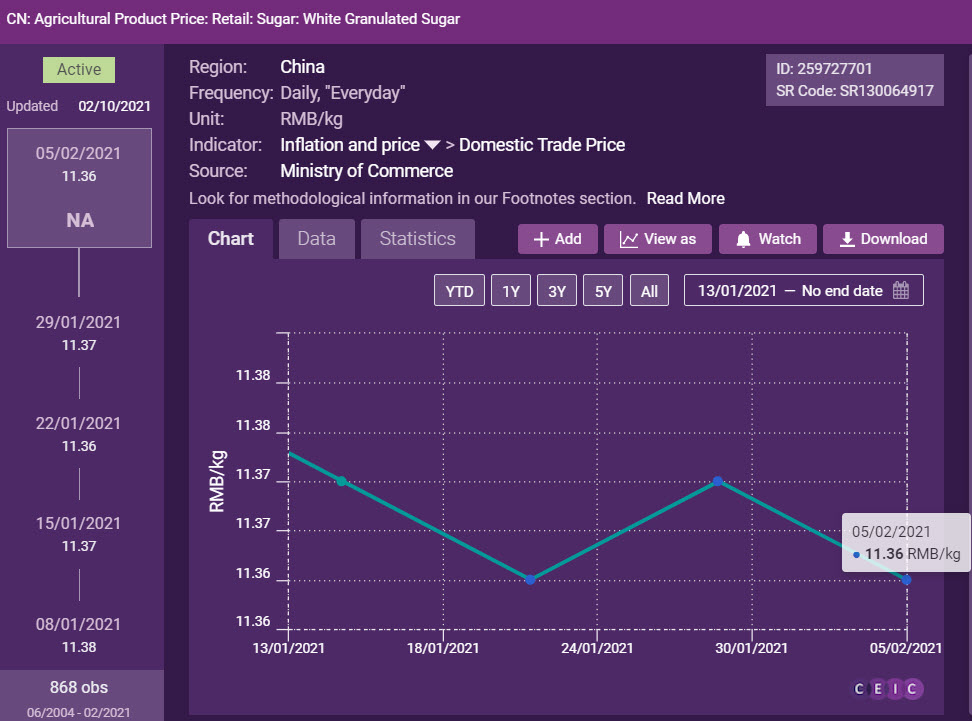

CEIC is a resource for global macroeconomic data. To access product price statistics from the CEIC landing page, open the Indicator menu and do a keyword search for price. Consumer or retail price statistics are available for a variety of products for countries throughout the world.

The CEIC chart below reflects recent retail prices of white granulated sugar in China:

The data can also be viewed and downloaded as a table:

When your research calls for product prices, start by exploring the databases above and contact a Lippincott Librarian for additional assistance.

by country. These are generally produced on a quarterly basis and include country overviews called “factsheets” which include quarter-by-qua

by country. These are generally produced on a quarterly basis and include country overviews called “factsheets” which include quarter-by-qua